Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Summary: Drafting a debt Summons Response (formally known as an Answer) doesn’t have to be so hard. Just address each claims against you and include relevant affirmative defenses. Be sure to file your Answer before the deadline to avoid default judgment. Finally, resolve your debt by negotiating a debt settlement plan. SoloSuit can help you draft and file your Answer and settle your debt before going to court.

Dealing with debt is never an easy experience. And if you've received a summons for a debt collection lawsuit, it's natural to feel overwhelmed. Ignoring it, however, is the worst thing you can do, as it may result in a default judgment against you, impacting your credit score and leading to wage garnishment or property seizure. This blog post aims to guide you through the process of responding to a debt Summons effectively.

A Summons is a legal document that notifies you of a pending lawsuit and outlines the steps you must take to respond. If you've received a Summons concerning a debt you owe, this means a creditor or collection agency has filed a lawsuit against you.

The Summons is typically accompanied by a Complaint (also known as a Petition in some states). The Complaint lists the specific claims that the creditor or debt collector is making against you, including the debt amount.

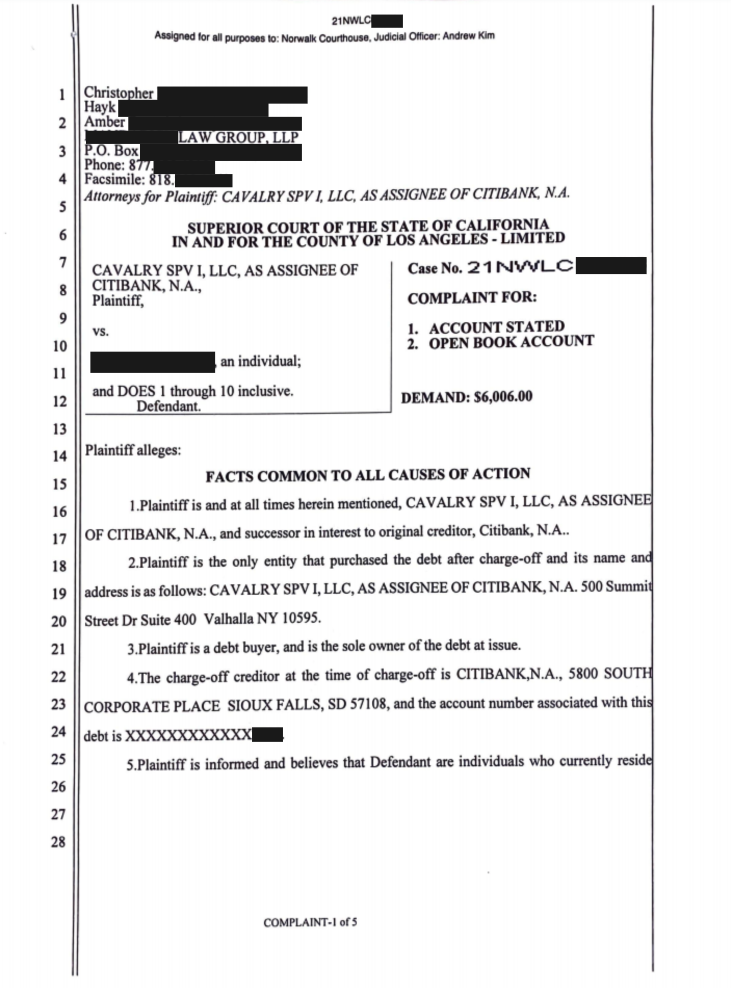

Here is an example of a real Summons and Complaint that initiated a debt lawsuit:

When you receive a Summons for debt collection, it’s important to take action. Here are the initial steps you should take in order to submit a Summons response.

Next, it’s time for you to draft a Summons response and file it in court. Here’s how.

The official name of a Summons response is the Answer. Here are some steps you should take while drafting your Answer document:

At this stage in the lawsuit, you should avoid giving out too much information. Responding with an elaborate description of your experience with the debt collector can actually end up hurting your case. Instead, your Answer should focus on responding to each claim listed in the Complaint document. Break down each claim made by the creditor or collection agency. Do you agree with them? Are they accurate and substantiated? Then, respond.

After reviewing each claim, it’s time to respond. In your Answer, include a numbered list of responses that address each claim from the Complaint. Most attorneys recommend denying as many of the claims as possible. There may be some claims that are obviously true (for example, it may list your name or home address as one of the claims), and it's not a big deal to admit to those types of claims. But you will strengthen your case when you deny the debt collectors claims, because they must prove anything that is denied.

After you've responded to each claim, you should include a section for your affirmative defenses, also presented as a list. An affirmative defense is any legal reason that the debt collector doesn't have a case against you. For example, the statute of limitations has expired, the debt has been paid or settled, or the debt is not yours due to identity theft or error. SoloSuit can help you come up with a list of affirmative defenses, in proper legal language, that will strengthen your side of the case.

Your Answer needs to be neat and professional. You should use standard font and margins (12pt, Arial, etc.). You should also include a case caption that outlines the court's name, parties involved, and case number. The body of your Answer contains your responses and affirmative defenses (as discussed above). Finally, you may include a statement at the end that explains what you wish the court to do (e.g., dismiss the case, award costs to you, etc.). This is known as the prayer for relief. SoloSuit's Answer form includes all these features and more.

Some courts require you to include proof that you served the opposing party. This is often called a certificate of service, and it should be found at the end of the document. This is where you list the name and address of the party to whom you sent a copy of your Answer. SoloSuit's Answer form also includes a certificate of service.

Don't forget to sign your Answer! Most courts reject any Answer documents that do not include a signature, so while this may seem like a simple step, it is often the most important!

To learn more about these six tips, check out this video:

Now that you’ve drafted your Answer, it’s time to officially submit it to the court and the opposing attorney.

Note: If you fail to file your Answer and serve the plaintiff before your state’s deadline, you may lose the case automatically when the plaintiff requests a default judgment against you. If granted, a default judgment can give them the right to garnish your wages, seize your property, and even freeze your bank account.

Check the deadline to file a debt Summons response in your state below:

This calculator is for educational purposes only. It does not factor in weekends or holidays, so your actual deadline may be some days later.

After you’ve filed an Answer, it’s time to await the response. The plaintiff may reply to your Answer by dismissing the case or moving forward with more legal action.

If the plaintiff wants to move forward with the case, discovery will begin. Discovery is the process by which both parties uncover facts, documentation, and other evidence against the opposing party to help their own case.

You may be required to attend a pretrial hearing or conference. This may be a good time to discuss debt settlement options with the opposing party. If no settlement is reached, the case typically goes to trial where a judge or jury will make a decision.

Debt settlement can be your best option if you know you owe the debt and you want to clear your name of it for good. When you respond to the Summons for debt, you can buy yourself time to negotiate a debt settlement agreement or payment plan with the opposing lawyer.

In a debt settlement, you offer a portion of the total amount due, usually at least 60% of the debt’s value. In exchange for a lump-sum payment, the creditor or collector agrees to drop any legal claims against you and release you from the remaining balance.

Once you've reached a settlement with your creditor, you should ask for a written agreement that outlines the terms you've agreed upon. Don't make any payments until you have this in hand. Finally, be sure to follow through on your end and make all payments as agreed upon. Late or missed payments can nullify your agreement.

For tips on how to negotiate a debt settlement, check out this video:

SoloSettle, powered by SoloSuit, is a tech-based approach to debt settlement. Our software helps you send and receive settlement offers until you reach an agreement with the collector. Once an agreement is reached, we’ll help you manage the settlement documentation and transfer your payment to the creditor or debt collector, helping you keep your financial information private and secure.

The best part about debt settlement is that it clears your name of the debt, and collectors will no longer contact you. Plus, debt settlement has less of an impact on your credit than not paying the debt at all.

Responding to a debt Summons is a critical step in resolving your debts. While the process can be daunting, understanding your rights and the legal steps involved can empower you to tackle the situation head-on. SoloSettle makes it easier to resolve your debt through settlement.

SoloSuit makes it easy to fight debt collectors.

You can use SoloSuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt.

SoloSuit's Answer service is a step-by-step web-app that asks you all the necessary questions to complete your Answer. Upon completion, we'll have an attorney review your document and we'll file it for you.

Here's a list of guides for other states.

Being sued by a different debt collector? Were making guides on how to beat each one.

You can ask your questions on the SoloSuit forum and the community will help you out. Whether you need help now are are just look for support, we're here for you.

Is your credit card company suing you? Learn how you can beat each one.

Need more info on statutes of limitations? Read our 50-state guide.